Plant-Based Meat Substitutes on a Growth Trajectory

A growing number of plant-based meat style products have been hitting the shelves over the last two years, including those from global brands such as Impossible Foods and Beyond Burger, long-time vegetarian brands like Vegie Delights and Tofurky, house brands like ColesŌĆÖ Herb & Sons, and more recent Australian brands like Made With Plants and V2food. But what is the growth trajectory actually looking like?

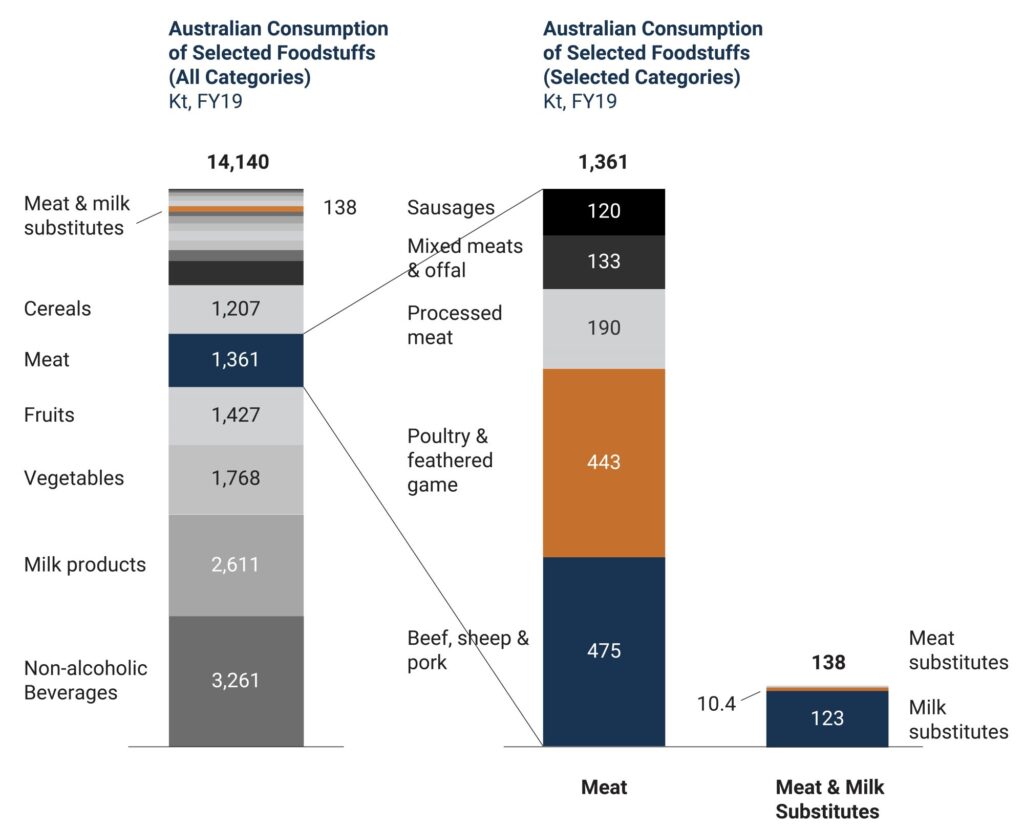

According to FY19 ABS data, meat substitutes represented 0.8% of the volume of meat consumption, which suggests that the category is nascent, but anecdotal evidence points to high growth potential. As a possible gauge of this future potential, milk substitutes now represent 7% of milk consumption. How close to that might plant-based meat products grow? It is worth noting that:

- milk

substitutes are a more mature category; - they

have been partly driven by dietary needs such as lactose intolerance rather than

a dietary preference or environmental and animal welfare consciousness; and - the taste, texture and cooking properties of

milk are far easier to mimic than meat!

Australian consumption of selected foodstuffs, FY19

With that said, clearly plant-based meat consumption is growing. Coles and Woolworths, for example, have both publicly indicated that they have seen double-digit growth in the category. The question is how much it will grow into the future, and projections vary significantly. According to Marketsandmarkets, Asia Pacific consumption is forecast to grow at 12% p.a. to 2025. According to Barclays, global revenue is forecast to grow at 26% p.a. to 2029. According to Deloitte Access Economics research commissioned by Food Frontiers, a plant-based protein think tank, Australian revenue is forecast to grow at 23% to 37% p.a. to 2030, with 31% as a ŌĆśmoderateŌĆÖ scenario.

Clearly, industry and the investment market see the growth potential in plant-based meat substitutes as genuine. In 2020 alone, at least US$1.3b in capital has been raised, including $77m by V2food in Australia, and other players in our region across Singapore, Hong Kong and Thailand. Australia certainly seems well placed to support and benefit from the global uptake of plant-based meat style products, given our strong agriculture, technology and innovation, combined with our strong provenance credentials and the appeal of Australian products in global export markets.

Plant-based meat substitute capital raisings in 2020

However, according to our discussions with a number of industry experts, the uptake in Australia has been more gradual than previously anticipated. In their view this been due to a combination of lack of awareness, inconsistent product quality (mainly in terms of taste and texture) across multiple brands in the market, nutrition concerns and price. Current prices, for example, are likely to be a barrier to penetration ŌĆō plant-based minces are currently priced at a ~70% premium to regular meat minces, and at a ~30% premium to grass-fed meat minces and branded gourmet organic meat minces. It seems likely that each of these issues will continue to be addressed as products continue to improve in taste, nutrition and pricing.

Consumption of plant-based meat style products is growing significantly. The question is not whether it will continue to grow significantly, only how fast it will grow, and which players will best meet the needs of consumers.

For further information, please contact us here.