Finding the Optimal Capital Structure

Finding and maintaining the right capital structure is critical to minimising the organisation’s cost of capital and maximising its value creation potential. Striking the right balance between debt and equity funding can be a challenge for many businesses, particularly in capital intensive and/or cyclical industries where revenues, earnings and cash flows can have a high degree of variability over time.

There might be a temptation for profitable businesses to maintain a low debt-to-equity ratio (compared to the industry average) or even to become debt free as quickly as possible to reduce the overall risk profile of the business. However, being under-levered has a number of significant drawbacks, most notably limiting the ability of the business to target and fund growth opportunities (i.e. through raising additional equity capital). This ultimately impacts the business’s ability to increase profits and generate greater shareholder value. The other, more apparent drawback is that debt capital is generally cheaper than equity capital, and maintaining an optimal level of debt within the business will typically result in a lower average cost of capital.

What are the critical capital structure questions that Boards and Executive Management need to answer?

There are several considerations when deciding what the optimal capital structure for a business should be. Typically, the following critical questions will need to be answered:

- What is the acceptable gearing range outside which the business’s capital structure should not wander?

- Does this gearing range allow the business to satisfy the ongoing returns expected by shareholders?

- Do the expected shareholder returns need to be adjusted to promote growth initiatives and funding?

- What is the most appropriate gearing target in the short, medium and long term?

- What policies and processes are required to ensure that inevitable short-term variability in gearing is managed appropriately?

- If the business is optimally geared, is the business paying the right price for its debt capital base?

Key capital structure considerations

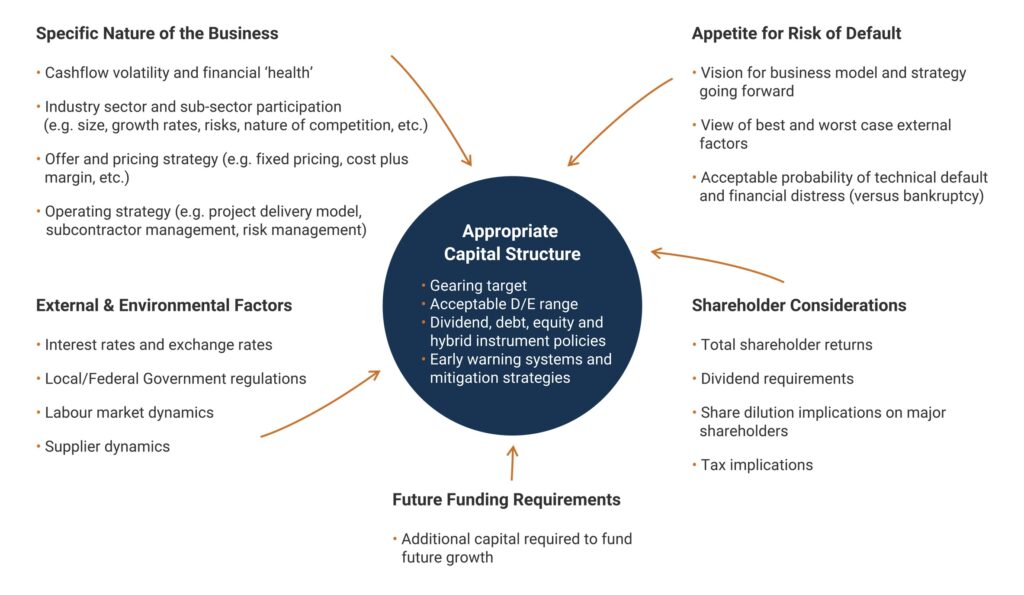

In Mainsheet’s experience, agreeing an appropriate capital structure and policy requires companies to balance the trade-offs between several key factors impacting its business as illustrated in the diagram below. These factors are specific to each business and Mainsheet works with its clients to determine which ones are appropriate for them.

The current low-cost debt funding environment

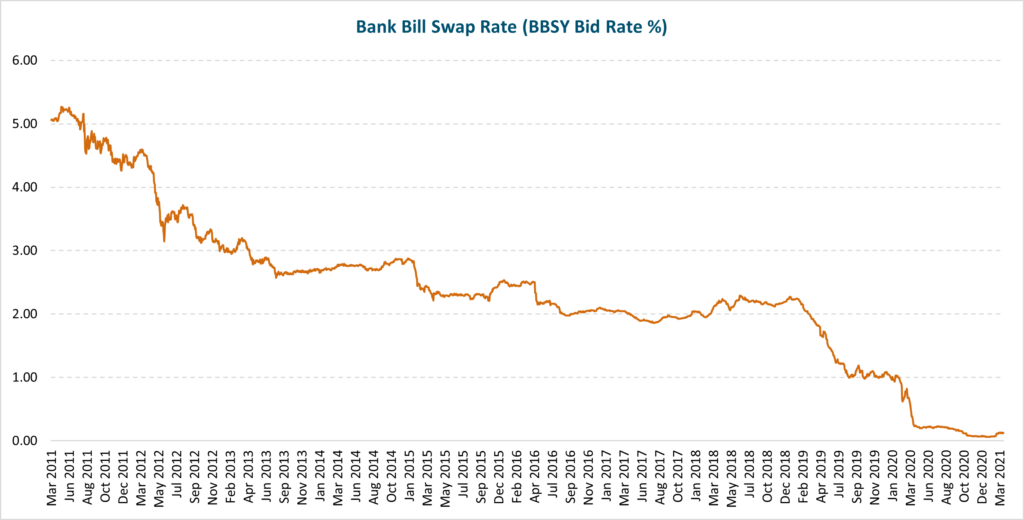

In response to the global financial crisis in 2009 and the COVID-19 pandemic in 2020, the Reserve Bank of Australia and other major federal banks across the globe have significantly reduced cash interest rates to drive private and public investment to avoid lengthy periods of economic recession. The flow on effect of this has been a significant reduction in debt funding costs across the business and corporate landscape.

Some businesses, through a combination of good underlying performance and structured forward planning, have undertaken capital restructuring and/or debt refinancing programs to follow the reduction in interest rates and reduce their overall debt servicing costs, while also optimising their capital structure mix between debt and equity funding.

Other businesses have been driven to undertake broader capital restructuring and capital raising through necessity, driven by the significant impact of the COVID-19 pandemic to their performance. For example, Webjet acted early to not only restructure its capital funding base, but to also restructure the operations of the business to ensure the survival of the business through the pandemic’s worst months.

Conversely, some businesses are still operating with sub-optimal capital structures and/or have debt facilities at higher than current market interest rates. If these businesses have existing underlying performance issues and are already highly levered, undertaking debt restructuring or refinancing, or even raising further equity to fund turnaround and growth initiatives, can be difficult. In the event such a business is able to refinance its debt facilities, the debt funding costs (i.e. interest rates) are typically still higher (through bank and non-bank lenders) than the lowest interest rates offered in the market (typically by the big banks).

Demand for growth capital is increasing

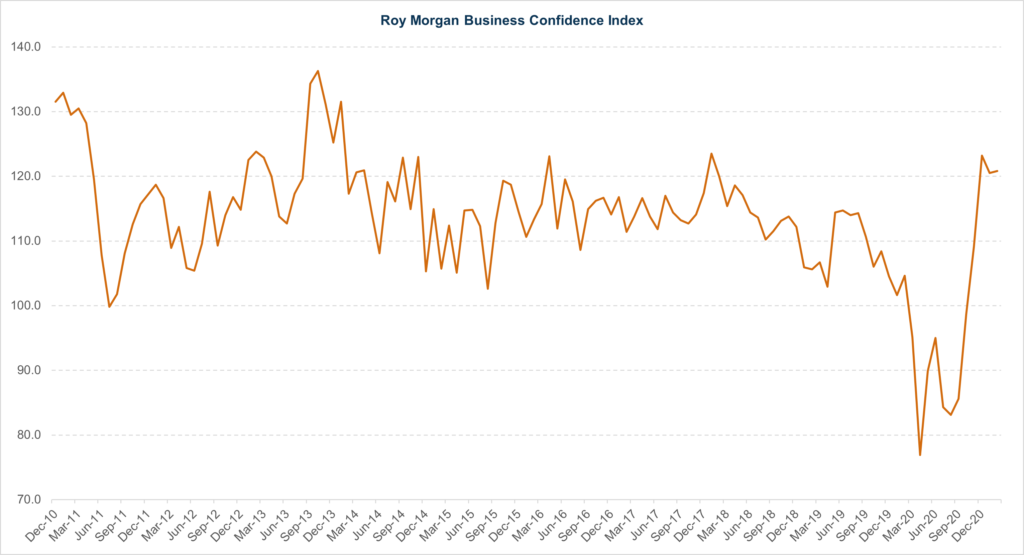

Compared to other major global economies such as the US, the UK, Europe and parts of Asia, Australia’s response to the COVID-19 pandemic has been a great success. The state-based border shutdowns are over (for now!) and the vaccine roll-out in Australia is underway. Under official measurement, Australia is out of its brief technical recession. While the recovery to pre-pandemic levels still has a way to go, business confidence and investment levels are growing.

The Roy Morgan Business Confidence survey, the largest of its kind in Australia, recently reported that Business Confidence averaged 121.5 points over the three months to February 2021, its highest three month average since January – March 2014. Additionally, the survey indicated that an increasing majority of 55% of businesses said that the next 12 months is a “good time to invest in growing the business” and 61% expect ”good times” for the Australian economy over the next 12 months.

This improvement in business confidence and the desire of many businesses to target operational growth and investment in the near term is driving greater demand for both debt and equity capital.

How can Mainsheet assist?

Mainsheet has demonstrable expertise in undertaking capital structure reviews and has assisted a number of clients with equity and debt capital raising and restructuring processes. For companies operating with sub-optimal capital structures and/or companies where operational underperformance is impacting on the business’s ability to service its debt, Mainsheet can assist in a number of ways, including:

- Restructuring or refinancing debt

facilities giving consideration to the various debt funding solutions and

financiers in the market; - Assisting businesses to develop and

implement performance improvement initiatives through a review of the

operational portfolio / business units; - Assisting businesses to develop

strategic growth plans substantiated by a detailed fact-base to support growth

funding requirements; and - Raising new equity giving

consideration to the various sources of equity funding (e.g. high net worth

individuals and family offices, private equity, venture capital, etc.)

If you would like to have a discussion around your capital structure and how best to optimise it for your current business needs and circumstances, please contact us here.