Australia’s Grid: The Electrical Transition

AustraliaŌĆÖs once in a lifetime, complex, irreversible energy transformation is underway, in an effort to reduce reliance on fossil fuels and the nationŌĆÖs carbon emissions. Energy, which includes electricity, stationary energy, transport and fugitive emissions, currently accounts for over three-quarters of AustraliaŌĆÖs emissions. While electricity generation currently accounts for a third of all emissions, this will significantly change as the electrification of the nation progresses and electricity is used to power close to the entirety of the stationary energy and transport sectors.

With the Australian Energy Market Operator (AEMO) predicting that electricity usage from the grid will nearly double by 2050, and become almost completely powered by solar, wind, batteries and pumped hydro, it is no surprise that the power sector is now in the spotlight.

This article summarises recent developments that are accelerating the transition, the significant changes required by 2050, and the host of opportunities that will be unlocked for various industry participants.

WHAT IS ACCELERATING THE TRANSITION?

A number of recent developments have contributed to the acceleration of the transition. These include:

- The new Federal GovernmentŌĆÖs 2030 emissions reduction target of 43% and ŌĆśPowering AustraliaŌĆÖ plan, including $20b investment in ŌĆśRewiring the NationŌĆÖ to rebuild and modernise AustraliaŌĆÖs grid

- Individual State emissions reduction targets, including NSW, VIC and SAŌĆÖs target of 50% reduction on 2005 levels by 2030, and QLDŌĆÖs equivalent 30% target. WA has also set a whole-of-government 2030 emissions reduction target of 80% below 2020 levels, and NT has announced a 50% reduction in emissions by 2030

- Corporate decarbonisation target acceleration, with 21 of the 23 companies that participated in the 2022 Corporate Emissions Reduction Transparency (CERT) report pilot committing to reach net zero emissions or 100% renewable electricity before 2050

- Renewable costs declining (renewables are now the cheapest source of energy according to CSIRO GenCost 2021-22 levelised cost of electricity report)

- Early closure of coal fired plants, with AEMO forecasting the withdrawal of 60% of current coal capacity by 2030.

WHAT ARE THE CHANGES REQUIRED BY 2050?

The National Electricity Market (NEM) operates on one of the worldŌĆÖs longest interconnected systems operating in NSW, ACT, QLD, SA, VIC and TAS. WA has its own two separate grids ŌĆō the South West Interconnected System (SWIS) and the North West Interconnected System (NWIS), and NT operates the Northern Network Grid, the Tennant Creek network grid and the Southern Electrical Grid.

AEMO has released a 2022 Integrated System Plan (ISP) which sets out an Optimal Development Path (ODP); a roadmap for the (NEM) transition. AEMO also contributed alongside Western Power to the Whole of System Plan (WOSP) which was led by Energy Policy WA, and provides an informed view on what the SWIS might look like over the coming decade. As for NT, the Darwin-Katherine Electricity System Plan has been developed to assist in the transformation of the power system into a grid for the future with the target of 50% renewable energy by 2030, focusing on the Northern Network Grid.

The ISP studies have found that under the ODP, large scale augmentation and repurposing of the transmission grid will be required to move from centralised to decentralised generation, and over $300 billion of investment will be required in generation, storage and transmission capacity over the period to 2050.

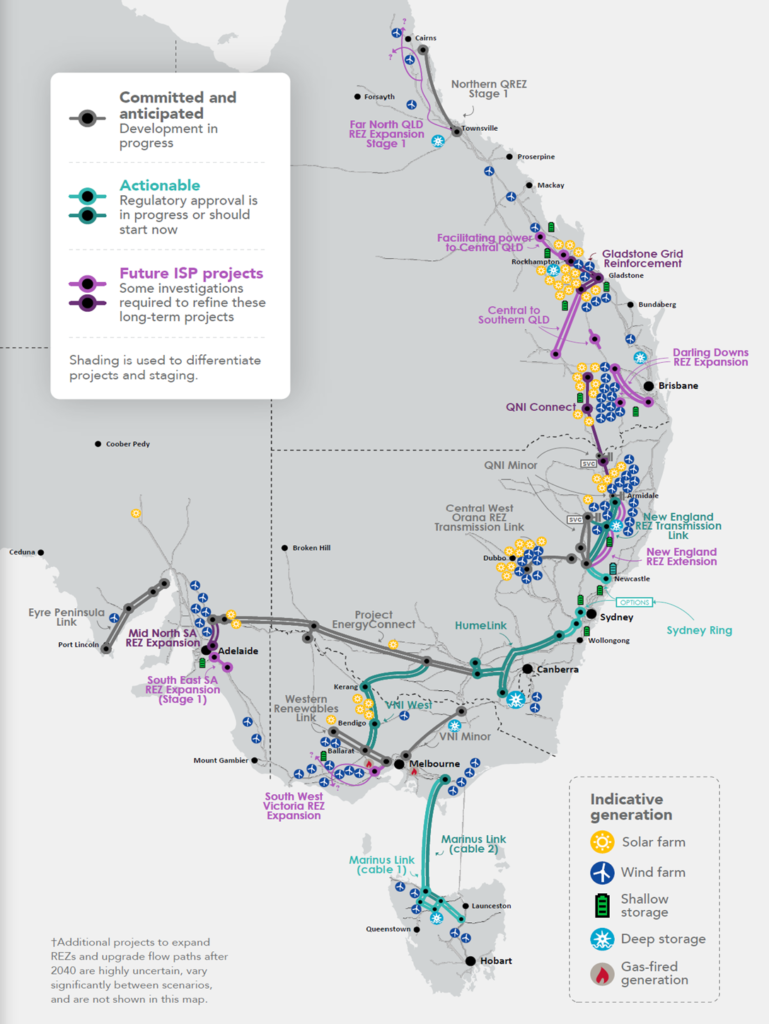

Figure 1: Network projects in the ODP – AEMO 2022 ISP

Highlights of the Integrated System Plan to 2050 include:

- Electricity usage to double due to

electrification and economic growth - >10,000 km of new transmission lines

- 126 GW of new utility-scale solar and wind (up

from 16 GW ŌĆō 9x increase) - >45 GW of new distributed solar PV (up from

15 GW ŌĆō 4x increase) - Storage capacity to increase by a factor of 25 (from

2 GW to 50 GW).

The SWIS already has renewables comprising 34% of installed capacity at the beginning of the modelling period.

Figure 2: Map of the SWIS and transmission network zones

Highlights from the WOSP include:

- Under all four modelling scenarios, over 70% of generation capacity is renewable by 2040

- Growth in intermittent generation is supported by firming from storage and gas facilities

- Coal-fired generation declines under all scenarios, and partially exits the market in the mid-2020s in the low demand growth scenarios.

WHAT ARE THE OPPORTUNITIES THAT WILL BE UNLOCKED?

This significant transformation will require an unprecedented level of investment and effort, and will take place both on the small-scale behind the meter level, as well as in utility-scale generation, storage and transmission. Capabilities required will impact a wide range industries from engineers to manufacturers, miners and even software developers.

Figure 3: The Opportunity

There are a number of questions being faced by companies, centred around understanding where they currently stand, what degree of exposure they have to electrical transition investment, whether that is sufficient, and how they might change that (i.e. through capabilities, presence, capacity and so on).

If well-positioned, players in the industry will unlock their potential to participate in this revolutionary decades-long investment.

If you would like to discuss further, please contact us here.