Recent M&A success – Exploring the impact of strategic rationale, relative size and frequency of deals

Following our March report on the performance of M&A in Western Australia, we have reviewed 93 acquisitions throughout Australia that were completed during FY2018. We found that 58% of acquirers underperformed the benchmark, the ASX300, one year from the closing date of their respective acquisition, which is consistent with the findings reported in our previous study.

In addition to the overall findings, we also assessed the impact of strategic rationale, relative size, and number of deals in the year on whether the acquirer outperformed the ASX300. Those companies that outperformed the benchmark most commonly pursued the transaction to increase their operating scale (rationale), targeted relatively small acquisitions (relative size), and executed multiple deals over the time period (frequency).

We have found that only one sub-category of eleven, acquisitions with the intent to increase operational capacity, did the majority of companies outperform the ASX300 Index.

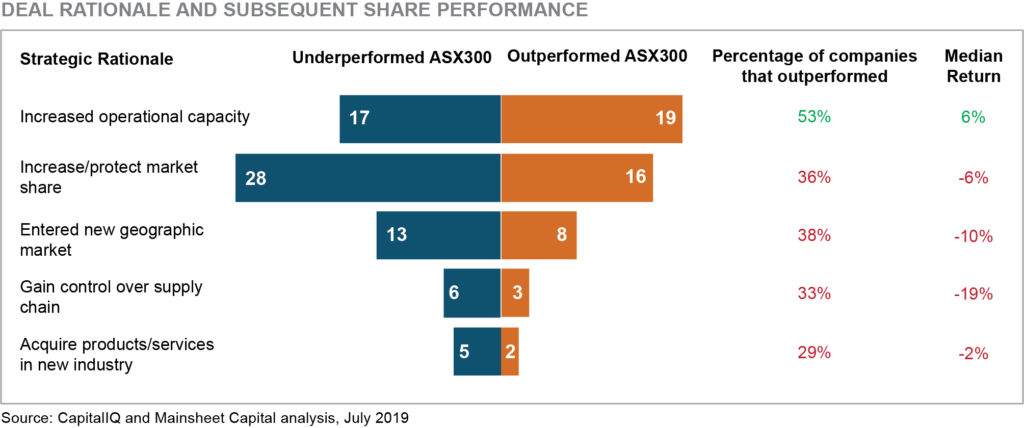

Strategic Rationale

We reviewed company reports and press releases associated with each of these transactions and grouped the acquirer’s strategic rationale into one of five categories. Only those companies that pursued a target to increase their operating scale saw a greater number of acquirers outperform the index than underperform.

The data is insufficient to make judgements on the impact of strategic rationale on the success of an acquisition, but it raises several questions:

- Does operational scale present fewer integration challenges than other motivations because maybe the acquirer already possesses the core competencies and assets presented in the target company? Operational scale is less risky and likely provides integration benefits faster?

- Does expanding to new geographic markets present cultural or legal environments unfamiliar to the acquirer? Is the acquirer able to retain and expand the market knowledge and network of the target company? Does the geographic distance constrain management’s ability to support the target company’s plans?

- Does expanding control along the supply chain or acquiring new products or services present challenges to a management team possibly unfamiliar with those new operations?

- Whilst adding new geographies and competencies is riskier, it also likely takes longer to generate benefits (versus the 1-year timeframe in this analysis)?

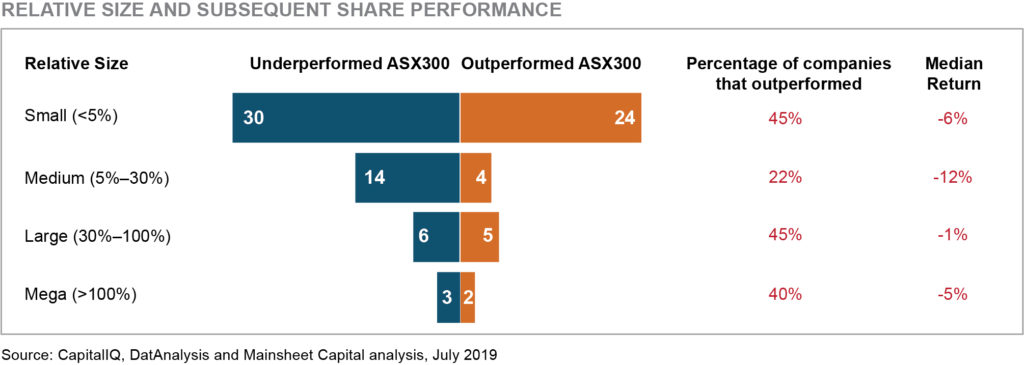

Relative Size

We measure relative size as the size of the target’s Enterprise Value (EV) relative to the market capitalisation of the acquirer, which we allocate into four categories: small (< 5%), medium (5%-30%), large (30%-100%), and mega (> 100%).

Observations, in addition to all categories underperforming the market benchmark include:

- We would expect there to be more governance and cultural challenges, from the results and our experience of deals, where the size of the target company is less than 5% of the acquirer.

- Medium deals performed the worst of the four categories. Is this because of the differences in the acquirer and target, or integration planning and execution challenges where execution is assumed easier given the relative size of the parties?

- Even though producing a negative median return, large and mega deals were the better performing groups. This could reflect the more aligned governance and management approaches of similar size parties.

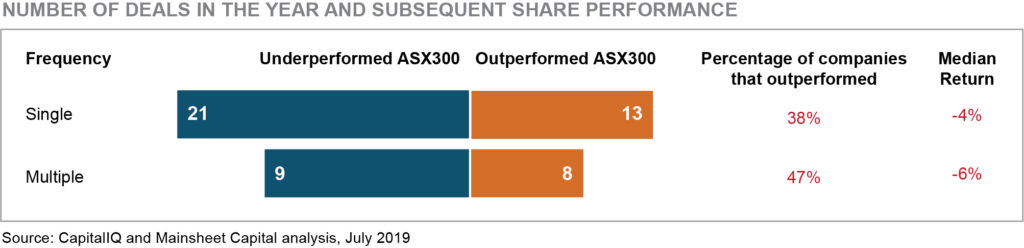

Deal frequency in the year

We reviewed the number of deals in which companies performed acquisitions during FY2018 and found that more companies underperformed the Index for both a single transaction and multiple transactions in the year. Regardless of transaction frequency, this suggests that M&A and integration are critical business competencies, where experience makes a difference.

Final comments

Integration is a dynamic and time-intensive exercise that strains management’s capacity to run the business while also leading the integration. It is also a practiced skill, like any competency, that needs focus and development if acquisitions are a core part of a company’s strategy. See our previous post that presents the Mainsheet Integration Framework.

Thanks to Chris Micks and Nick Sullivan in the Mainsheet Capital team for their research.

If you want to talk about these or other questions, please contact us here.

Mainsheet, a consulting firm in Sydney, is currently engaged in three M&A integration projects across a number of industries and look forward to supporting companies outperform their peers in value creation through transactions.