eCommerce, Transport & Logistics and the Last Mile

The growth in eCommerce has driven a large structural change in supply chain logistics, with the last mile leg increasing in volume and becoming more pivotal to a businessŌĆÖs success. Expectations set by large dominant online retailers have changed consumer attitudes, with consumers demanding speedy fulfilment and high levels of transparency, adding additional costs to already costly last mile operations. With recent increases in logistics costs, it is imperative that providers develop more efficiencies into their operations. Legacy transportation providers and large retailers are responding to new market entrants by adopting similar last mile strategies and technologies.

eCommerce growth

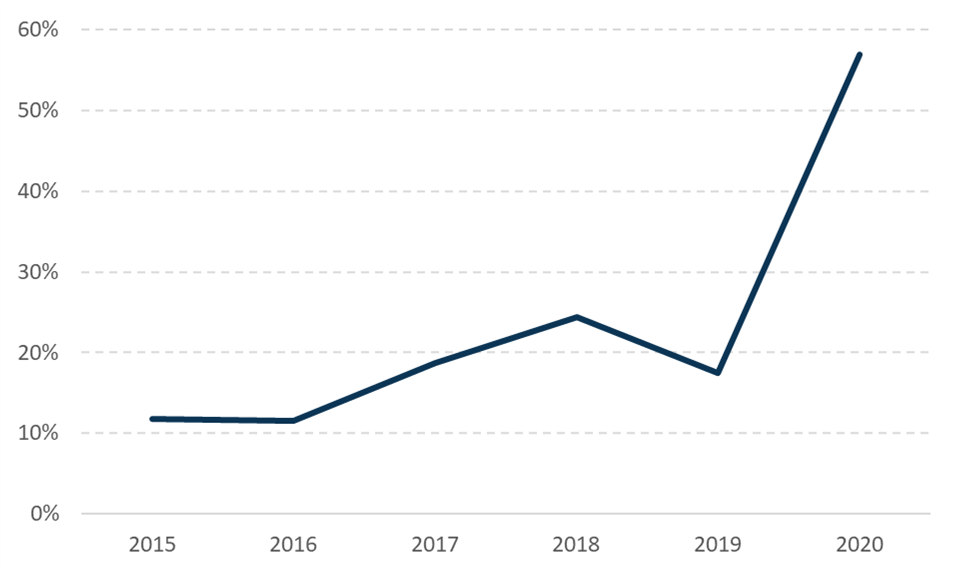

The COVID-19 pandemic has brought many permanent changes to operations across various industry sectors. Retail purchases have been steadily shifting towards online, and COVID-19 has accelerated this change, with online purchases (excluding food delivery services) increasing 57% in 2020 compared to 2019.

YoY Online Retail Growth

While this may seem like a one-off event due to high levels of spending during lockdown periods, monthly data shows that even after restrictions were relaxed, online spending was relatively consistent with spending during lockdown.

Distribution of Online Sales in 2020

Forecasts are for eCommerce to continue its growth. Pre-COVID, Frost & Sullivan had estimated online penetration rates to grow to 19% in 2024; post-COVID it is estimating online penetration to grow to 25% in 2024.

This level of expected eCommerce growth has also driven large activity in commercial real estate, with 2021 experiencing record levels of investment into warehousing and logistics, with logistics providers also looking to stabilise and secure supply chains after recent disruptions.

While the growth in eCommerce has been a boon to retailers, it has also presented hurdles.

Last mile problem

Large online retailers in Australia (and even national grocery companies) have altered consumer expectations around eCommerce, with consumers demanding a higher level of reliability, efficiency, transparency and timeliness regarding shipping, while keeping costs as low as possible. The large increase in eCommerce spending along with the change in consumer expectations has required a shift in supply chain logistics, and with it a change in the last mile logistics landscape.

Even a seemingly hasty 2-hour delivery timeframe has been challenged in the grocery space, with deliveries now able to be received within 20 minutes of placing an order.

In addition to satisfying customer expectations, cost presents another issue. The complexity of routes and the large number of destinations, combined with missed deliveries and returns, all contribute to the high cost of last mile delivery, which accounts for up to 53% of overall shipping costs.

With logistics costs recently experiencing large increases, and many online retailers providing ŌĆśfree deliveryŌĆÖ services, it is becoming increasingly difficult to pass these costs onto consumers.

AustraliaŌĆÖs eCommerce growth in recent years have brought its online spending penetration rate to 16.3% in 2020, in line with other western countries around the world, which averaged between 15%-18% in 2019. While these countries have established arguably more sophisticated logistics networks, emulating the same models may not necessarily yield the same benefits in Australia due to its lower population density, geographic spread, and higher costs of labour.

Solutions

The transport and logistics industry has experienced a level of disruption in recent years. Being an industry which has traditionally been slow to adapt new technology, the growth of eCommerce has laid an inviting landscape for new companies to challenge the dominant providers, which has in turn forced incumbent providers to evolve their operations.

New gig-economy, SaaS-based courier services and platforms have emerged to assist retailers to address the last mile problem, embedded with AI driven route optimisation, while providing delivery scheduling options and real time tracking, aiming to provide low-cost shipping and achieve high customer satisfaction. Further, these services aim to reduce other associated costs with last mile delivery such as missed deliveries and idle time by confirming the customer will be at the drop off point within delivery windows.

Some technology-led courier services have been observed to improve their efficiencies in response to new market entrants by acquiring similar route optimisation technologies to further improve customer satisfaction and reduce costs.

Traditional parcel transportation providers have been investing in warehouse management systems, and streamlining fulfilment processes and inventory management processes to improve efficiencies and order accuracy. Leveraging their extensive logistics operations, providers such as DHL and FedEx have responded by tapping into the last mile sector, with DHL piloting same day delivery services in Germany, and FedEx expanding their same day services in certain markets.

Even Amazon, who has traditionally been an industry innovator/leader, has also adopted and incorporated crowd-sourced last mile courier services to further add value to their service offering, evolving from a more 3PL type model.

How can the midsized 3PL providers respond to the growing last mile market? Aside from investing into improving the operations of their warehousing through sophisticated management systems, providers need to ensure that customer experience remains a key priority for both the shipper and receiver. This requires 3PL to utilise the best available technology to improve timeliness and accuracy. 3PLs will increasingly need to show complete visibility to both retailers and customers, through the use of transport management and control tower platforms which provide real-time end-to-end visibility of the journey from order fulfilment to delivery. Further, 3PLs need to review the capability of their operations to cater for same day shipping partners.

Mainsheet has been assisting companies to define their strategy within the evolving market context, considering current and future capabilities and business models in different parts of the eCommerce value chain. To discuss this further please contact us here.