Commercial Due Diligence – Understanding Value in an Investment

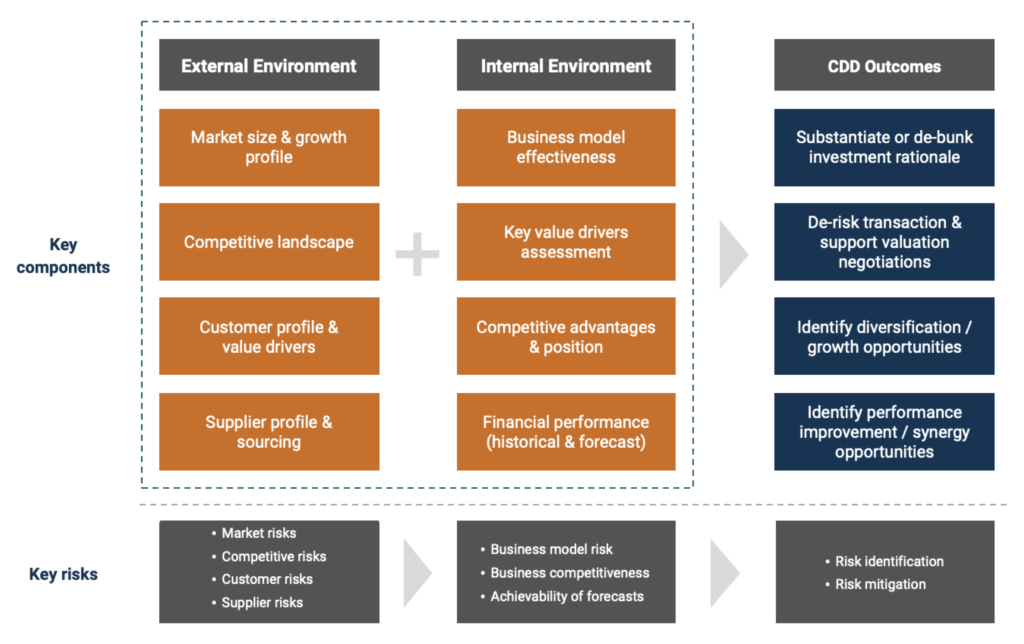

Commercial due diligence is typically commissioned by an equity or debt investor during the execution phase of an acquisition transaction or debt funding process. Together with financial, legal and tax due diligence, commercial due diligence forms an integral part of evaluating the target company and investment rationale.

While each type of due diligence is important to evaluate the target company in its entirety, commercial due diligence aims to understand, test, and substantiate the underlying strategic rationale and value creation thesis underpinning the acquisition or funding transaction. As such, commercial due diligence is generally seen as the most important step in evaluating an acquisition or investment opportunity, with the commercial attractiveness of the investment opportunity being the first hurdle to pass for the transaction to progress further.

Commercial due diligence can make the difference between a successful, value creating transaction and a value destroying one, assisting buyers and investors with the following key outcomes:

- Provides

deep knowledge of the business and its markets to make an informed investment

decision; - Substantiates

the strategic rationale and value creation thesis underpinning the transaction; - De-risks

the transaction and supports valuation negotiations; - Identifies

diversification and strategic growth opportunities; - Identifies

performance improvement and synergy opportunities; and - Identifies

key internal and external risks and mitigation strategies.

Ultimately, the commercial due diligence supports a buyer’s or financier’s decision to invest in a target company by providing an assessment of the achievability of the target’s plan in the context of the business’s internal and external environment.

Commercial due diligence reviews can have a broad scope but are generally tailored to address specific issues identified by the buyer or financier driven by their strategic and investment rationale.

While commercial due diligence reviews are typically commissioned by buyers (corporates and private equity) and debt capital lenders, they can also be commissioned by the sellers of a business. A vendor driven commercial due diligence has a number of key benefits which allows the seller to:

- Keep

control of the due diligence process and minimise disruption to the business; - Identify

potential issues buyers may raise early and develop strong and structured

responses; - Undertake

market and company analysis that the management team can confidently talk to; - Develop

balanced findings including potential upsides/opportunities and downsides/risks;

and - Confirm

the factual accuracy of the information to be provided to the buyer.

Mainsheet’s Commercial Due Diligence Offering

Mainsheet works collaboratively with its clients to ensure that as part of the commercial due diligence review, we address the critical factors underpinning the client’s decision to invest and the key focus areas pertaining to the risks that we see in firstly deriving post-transaction growth and value creation and secondly, completing the transaction by supporting buyer and seller negotiations. Mainsheet brings with it:

- Deep expertise and knowledge of the industry sectors and markets that we operate in, including

knowledge of the customer value drivers, key capabilities, business models and

key operational performance drivers; - The ability to leverage strong industry relationships and access to

industry experts to

fill in any knowledge gaps and provide clients with a deeper assessment of the

market and competitive landscape; - A

value driven outcome, supported by significant experience in developing

corporate and business unit growth and value creation strategies with

clients; - Independent and fact-base advice, supported by deep market, competitor and

business unit level research and analysis which is guided by the value creation

goal; and - The ability to provide an integrated offering, including post transaction

integration, performance improvement support and strategy refinement and

implementation.

Companies pursuing acquisitions, private equity funds and lenders are all rediscovering the critical importance of commercial due diligence in an investment process.Mainsheet has recently been engaged by several lenders to conduct commercial due diligence associated with new debt facilities, underpinning their investment case. Several companies have also engaged us to assess potential acquisition targets due to our comprehensive approach, knowledge of markets and business models, and proven ability to demonstrate valuation impacts.

If you would like to talk with us about a potential investment opportunity and the requirement for commercial due diligence, please contact us here or let me know what is preferred.