Positioning for Growth

in engineering, construction, mining and oil & gas services

Since the peak of activity 2012 / 2013 many engineering, mining and oil & gas services firms have experienced a significant reduction in market demand. This has caused many firms to have to substantially reduced staff numbers and narrowed capabilities and radically reduce their costs base. Today many of the firms in these sectors are substantially smaller than they were in 2011.

In contrast, since 2012 / 2013 most asset and resources owners (including big miners and O&G producers) have continued to invest and they have adopted new technologies to drive labour savings and capital efficiency.

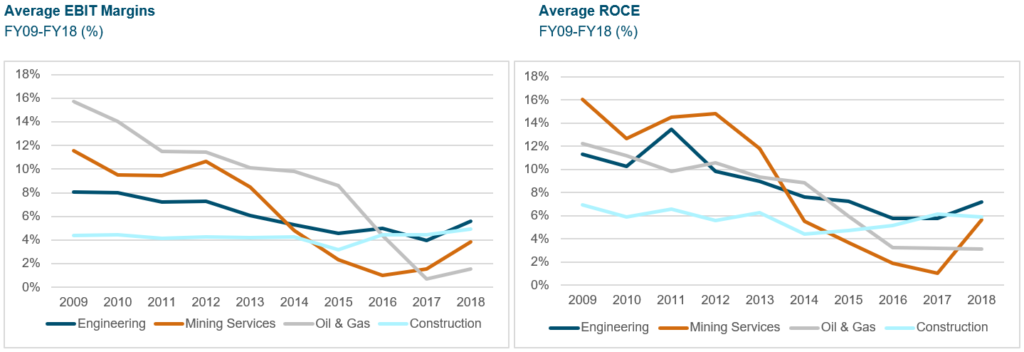

As a result these asset and resource owners now have technology demands that can stretch the capabilities of many of the services firms, particularly the smaller ones. From 2013 until about 2017 engineering, construction, mining and O&G services firms have on average experienced substantial reductions in EBIT margins and returns of capital employed (ROCE %).

The recent increase in market activity is clearly good news but it does bring with it a new set of challenges in terms of the service companies having sufficient operational scale, breadth of capabilities and balance sheet strength required to support the new projects being tendered in the market. The recent failure of several larger national services companies proves this point.

Services companies, both internationally and nationally, are responding to these new challenges by growing organically and pursuing mergers and acquisitions to increase their project delivery capability.

Additionally, some are acquiring smaller technology firms to fill the technology gaps they may have in their capabilities and IP domains.

Often this has required reviewing and restructuring their capital base and strengthening their balance sheet to be able to fund the new growth and exploit the lower interest rate environment.

Mainsheet has been assisting its clients to achieve these outcomes and has demonstrable expertise and track record of success.

If you would like to see more of this performance analysis then follow this link: https://www.mainsheet.com.au/economic-performance-and-value-creation-analysis/